3 Smart Ways to Responsibly Use Home Equity

Between 2020 and 2022, many Americans saw their home equity soar as the median sale price of U.S. homes increased by more than $120,000. If you own a home, that means your equity may have grown, too. And you may be considering different ways to use it, such as remodeling your home or paying off debt.

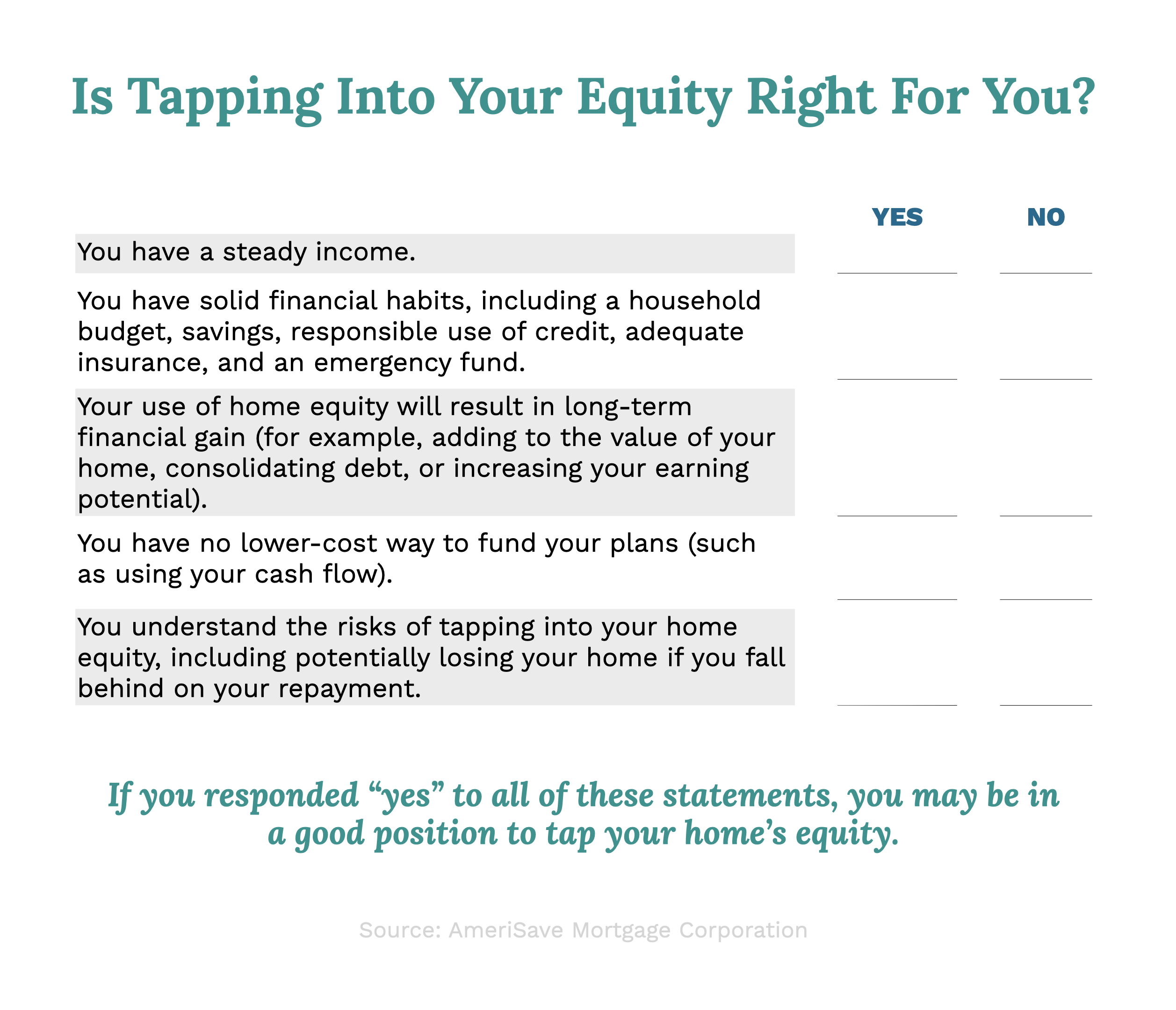

Tapping into your home’s equity can be a smart tool. But is it the right move for you?

That depends on your situation and how you use the funds. Let’s break down three of the best ways to use home equity — and a few situations where it might not be the best choice.

Benefits of using home equity

Tapping into your home equity can be a smart way to access funds while taking advantage of lower interest rates compared to personal loans or credit cards. Because home equity financing is backed by your property, it often comes with competitive rates, the potential to borrow a significant amount of capital, and considerable flexibility in how you use home equity funds.

Turn your home equity into opportunity

Building home equity and managing debt wisely are essential to developing financial stability and building wealth.

The good news? With the right approach, your home equity can be a powerful tool to help you reach your goals. With AmeriSave, you’re covered. Our experts guide you toward a solution that sets you up for success now and into the future.

Here are three of the best ways to use your home equity.

1. Debt consolidation: A smarter way forward

Financing backed by home equity generally comes with lower interest rates than unsecured credit products. As a result, if you’re carrying multiple high-interest debts, you may be able to reduce your borrowing costs by consolidating them with a home equity credit product.

Here’s how home equity products compare to other common financing options:

If you’re thinking about consolidating debt with a home equity loan, start by taking stock of your current debts. Make note of:

- Your outstanding balances

- Interest rates

- Fees

- Monthly payment amounts

- Months to payoff

- Total costs

From there, gather quotes for a home equity loan or a HELOC to see if it will help you save.

2. Home improvements that pay you back

Another popular way to put your home equity to work is by reinvesting it into your property. Strategic home improvements and repairs can improve your living space and boost your home’s resale value.

If you choose this route, it’s worth researching which home improvement projects offer the biggest return. According to the 2024 Cost vs. Value Report by The Journal of Light Construction, garage door replacements top the list for return on investment (ROI), followed by entry door replacements, stone veneer additions, fiberglass grand entrance additions, and minor kitchen remodels.

As an added bonus, the IRS may allow you to write off the interest you pay on your home equity loan or HELOC — as long as you use the funds to buy, build, or substantially improve the property securing the loan.

3. Invest in your tomorrow

Using your home equity funds wisely can open the door to exciting opportunities. Since you’ll be repaying the funds over time, it’s wise to invest in ways that can strengthen your financial future — be it by boosting your earning potential, building wealth, or creating new income streams. Here are some of the many possibilities:

- Higher education: If you or a family member is looking to pursue a career that requires higher education, funding college with your home equity funds could be beneficial. Also, research federal student financial aid programs, as they tend to be unsecured, have low interest rates, and offer unique protections.

- Starting a business: Looking to make a bet on yourself? Many entrepreneurs use home equity to fund a new venture, especially since traditional business loans can be difficult to secure or come with high interest rates. If you’re ready to take the leap, having a solid business plan and financial strategy in place can set you up for success.

- Investing in real estate: You can also use your home equity funds to invest in another property. For example, you could pull out enough cash to make a 20% down payment on a summer vacation home. Over time, real estate tends to appreciate, and rental income can create an additional revenue stream. Just keep in mind that owning another property comes with its own costs, such as insurance, maintenance, and furnishing—but with the right planning, it can be a strong wealth-building move.

Your game plan for managing home equity

Have an idea for using your home’s equity? Here’s what you need to know about assessing your equity position and the different ways to access it.

Understanding your equity position

Home equity is the difference between the value of your home and the amount you owe on your mortgage. To figure it out, you subtract your mortgage balance from your home’s current market value. For example:

- Current value: $300,000

- Mortgage balance: $100,000

- Home equity: $200,000

However, most home equity lenders only let you borrow about 80-85% of your home’s value. So, to estimate the maximum amount you can borrow from a specific lender, you’ll need to multiply your home’s value by the lender’s loan-to-value (LTV) limit and then subtract your remaining mortgage balance.

Continuing with the above example, if a lender’s LTV limit is 85%, you’d multiply your home’s value ($300,000) by the percentage you can borrow (0.85), which gives you $255,000. Then, subtract your mortgage balance ($100,000) from $255,000 to get the maximum amount you can borrow ($155,000).

Finding the right way to access your equity

There are multiple ways to tap into your home equity, including through a home equity loan, a HELOC, or a cash-out refinance loan. Here’s how each works:

Home equity loan

- How it works: A fixed-term installment loan secured by a second lien on your home, providing a lump sum upfront. You repay it through fixed payments, often with a fixed interest rate. Closing costs apply.

- Ideal for: One-time expenses like home renovations or debt consolidation.

Home equity line of credit (HELOC)

- How it works: A revolving credit line secured by a second lien on your home, allowing you to borrow as needed during a set draw period (often 10 years). Interest accrues only on outstanding balances, typically at a variable rate. Reduced or interest-only payments are common during the draw period, with a fully amortizing repayment period required afterward (often over 10 or 20 years). Closing costs apply.

- Ideal for: Providing ongoing access to funds for home improvements, tuition, or unexpected expenses.

- How it works: A new, larger mortgage that pays off your existing loan while allowing you to withdraw equity as cash. It replaces your current mortgage with a first-lien loan, repaid in fixed installments. Like a first mortgage, cash-out refinancing involves closing costs.

- Ideal for: Accessing home equity while potentially securing a lower mortgage rate, consolidating debt, or funding major expenses like home improvements or investments.

At AmeriSave, we make it easy to find the right home equity solution for your needs. Whether you’re looking for predictable payments with a home equity loan, flexible access to funds with a HELOC, or a fresh start with cash-out refinancing, our team of experts is here to help you compare options and maximize your savings.

What are the risks of using home equity?

While tapping into your home’s equity can open the door to exciting possibilities, it is important to borrow wisely. Since your home is your collateral, staying on top of payments is key to protecting your investment. And while home values generally trend upward, market fluctuations do sometimes impact equity. Additionally, closing costs come into play depending on the type of loan or line of credit you go with.

Think twice: When not to use home equity

While using home equity can be advantageous, it’s generally best to avoid splurges, risky investments, luxury purchases, or everyday items that won’t offer long-term benefits. Here are a few examples:

- Vacations: It can be tempting to use the cash available to fund the vacation of a lifetime. But you’ll have difficulty finding a financial expert who thinks this is a good reason to increase your debt and put your house on the line. The experience may be great, but it doesn’t offer any long-term financial benefits.

- Vehicles: The home equity route will often involve longer repayment terms than auto loans, meaning you could still be paying for the car long after you’ve sold it or traded it in. And if you miss payments on a car loan, you risk losing just the car. However, if you miss payments on a home equity loan or HELOC, you risk losing your home. For these reasons, an auto loan is often the better option.

- Speculative investments: Maybe a friend or colleague told you about a “can’t miss” stock, which has you thinking about quick ways to get cash to invest. But speculative investing always comes at high risk — one too significant to stake your home on.

- Small emergencies: One thing you learn quickly as a homeowner is that unexpected financial challenges occur frequently. A malfunctioning furnace, a leaky roof, a freezer on the fritz, or a burst pipe are all examples of things that can (and do) go wrong. But these types of issues shouldn’t cause you to go deeper into debt. Plan for these by building an emergency fund.

FAQ

Have more questions about using home equity? Find quick answers below.

Can I use home equity for anything?

Yes, you can typically use home equity funding for any purpose you want. Lenders don’t usually put restrictions on how you spend the funds. However, since your home will serve as collateral, it’s best to focus on investments that offer long-term financial benefits.

How can I build equity in my home?

You start building home equity when you buy a home with a mortgage and make a down payment. For example, a $60,000 (20%) down payment on a $300,000 home is your initial equity. You can then grow it over time by making mortgage payments, benefiting from appreciation, and increasing your home’s value through upgrades.

How do I responsibly manage home equity?

To manage home equity responsibly, it’s important to be mindful of the amount you borrow and how you spend it. Don’t commit to a loan with monthly payments that will stretch your budget too thin — ensure you always make all your payments on time. Further, avoid spending the funds in ways that won’t provide a long-term ROI.

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation