Home Equity Line of Credit vs Home Equity Loan

Soaring home values have many Americans tapping for cash — is it the right approach for you?

Buying a house vs. renovating: Questions to ask

“Stay or move?” is often not just a practical question but an emotional one. We grow to love homes, neighbors, and communities. They’re part of who we are, and it can be hard to start over in a new place. Adding children to the mix — with their attachment to schools, friends, sports, and other activities — only intensifies the emotional challenge of a move.

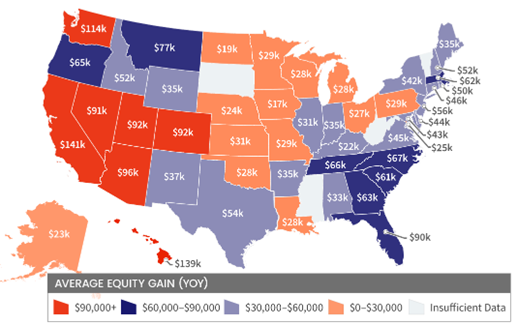

Home values have grown significantly in the past two years. According to a September 2022 report by CoreLogic, in the first quarter of 2022, the average U.S. homeowner gained nearly $64,000 in equity compared to the first quarter of 2021.

This has many homeowners — maybe you — asking whether the time is right to access the cash you have tied up in your home. You can do it through home equity financing.

What is home equity financing?

Provided by a mortgage lender, home equity financing allows you to borrow money against the equity in your home. There are no restrictions on how you use this cash, and you’ll typically have an interest rate that’s lower than what you’d get with other personal loans and credit cards that have a minimum monthly payment.

There are three common ways to access the equity in your home:

- With a home equity loan, you receive the entire loan amount as a lump sum payment with repayment terms set to a fixed interest rate over a specified length of time.

- With a home equity line of credit (HELOC), you have access to money that can be drawn as needed, repaid over time, and accessed again. As a revolving line of credit, a HELOC is similar to a credit card.

- With a cash-out refinance, you replace your current mortgage with a new mortgage of higher value. You use the new mortgage to pay off the original mortgage and take the remainder as a lump sum of cash.

As we’ve covered cash-out refinancing elsewhere on our website, we’ll focus primarily on home equity loans and HELOCs in this article.

Home equity offerings vary, so reviewing the terms and conditions applicable to the product you’re considering is important. The information in this article is provided to help you better understand these options and may not reflect products or offerings available from AmeriSave.

Home equity trends in 2022

According to CoreLogic, U.S. homeowners with mortgages collectively saw their equity grow by $3.6 trillion, or 27.8%, compared to the second quarter of 2021. This growth is primarily the result of increasing home values.

“Multiple factors have led to increasing home values,” says Mike Bloch, senior vice president, Operations, for AmeriSave. “First is a rise in the cost of lumber and construction materials, driving the cost of new construction. Second is the pandemic, which has prompted many people to want to move either into larger homes or to new areas. And the fact that there are not enough homes on the market to sell has created the third factor — bidding wars that are driving up the selling costs of homes.”

These factors have created a unique environment in 2022. The market value of your home may be higher than ever before, building even greater home equity. And you have the tools to access it.

“I always think it’s a good idea to intelligently utilize the equity in your home when it can help your financial situation in the long term,” says Bloch. “Maybe it’s for a home addition or to pay off existing credit card debt or student loans or anything with a very high-interest rate. You can even tap your home equity to get money to invest — just be sure to talk to your CPA and financial advisor first.”

Source: CoreLogic

How to get a home equity loan or HELOC

You can apply for a home equity loan or HELOC similarly to how you apply for a mortgage. First, research and contact the mortgage lenders you want to do business with. The lender then will gather some information and let you know if you qualify to borrow, the personalized interest rate, loan term, and monthly payment(s).

Most lenders will allow you to borrow up to 80% of the value of your home (some HELOC providers allow up to 95%) minus what you owe on your primary mortgage. Of course, the more you borrow, the higher your monthly payment will be. Take this opportunity to decide carefully how much money you need and how much of a monthly payment your budget can afford.

Once satisfied with the terms, you’ll complete a more thorough application. The lender, in turn, will then do a more thorough underwriting. This includes performing a hard pull of your credit report and requiring proof of your income.

With a home equity loan, you’ll receive a lump sum payment that you can deposit in your bank account and use as needed. Your lender will provide a monthly repayment schedule, including principal and interest, and the loan’s term. The loan term typically ranges from 10 to 30 years.

With a HELOC, you’ll be able to draw on the available funds (up to a lump sum payment for the entire approved amount) and use that money as needed. As you pay down the HELOC over time, you can get more money at any point during the draw period (typically 10 to 15 years).

If you have a primary mortgage, you’ll make the home equity loan or HELOC payment in addition to the primary mortgage payment. This is why these borrowing options are often called “second mortgages.”

Home equity loan and HELOC requirements and borrowing limits

As with a primary mortgage, you’ll need to meet some minimum requirements to qualify for a home equity loan or HELOC. These vary by lender but typically include:

- Good credit

- A minimum level of equity in your home and minimum loan-to-value ratio

- Proof of steady income to show your ability to repay the loan

- A low debt-to-income (DTI) ratio

Your lender may also require an independent home appraisal to confirm your home’s value and to help determine the amount of equity you have available. Some lenders can even use an automated home valuation, which helps streamline the process.

Your eligibility and personalized interest rate will be based on how well you meet a lender’s requirements. For instance, a higher credit score and lower DTI ratio should get you more favorable terms.

The home equity application and approval process is similar to that of a primary mortgage.

HELOC example

Let’s say you want to hire a contractor to complete various remodeling jobs around your house. Your goal is to update some of your spaces and add value to your property.

You get multiple quotes and choose a contractor estimating the work at $50,000. The contractor estimates needing nine months to complete all the work.

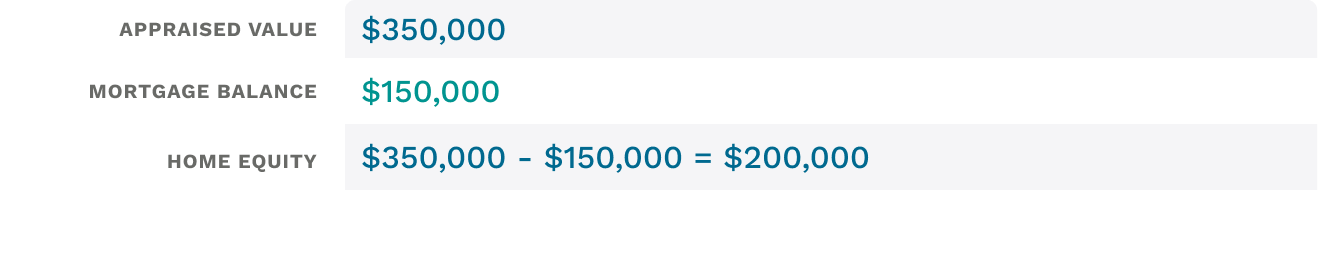

Your home’s appraised value is $350,000, and you have a $150,000 mortgage balance. You calculate your equity by subtracting the mortgage balance from the home’s value.

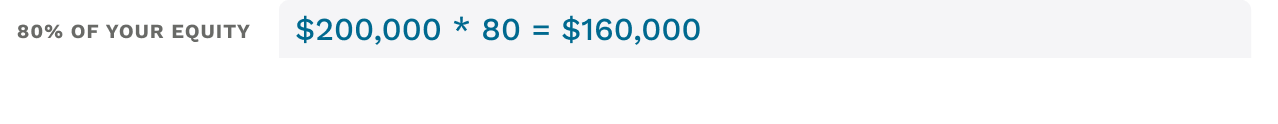

You discuss a HELOC with your mortgage lender. The lender prequalifies you to borrow up to 80% of your equity.

You apply to borrow $75,000. This will cover the $50,000 estimated cost of the work while leaving a $25,000 cushion of cash for potential overruns or other significant expenses.

The lender approves the HELOC at a 5.5% variable interest rate with a 10-year draw period, followed by a 20-year repayment period. You hire the contractor and draw funds from the HELOC as needed to pay for the work. Your minimum payments during the draw period are interest only (though you have the option to pay down the principal as well). Once the draw period ends, you pay both interest and principal.

Don’t forget that you’ll be making this payment in addition to the payment for your primary mortgage. So, budget accordingly!

Some pros and cons of home equity loans and HELOCs

If you’ve built considerable home equity and need a significant amount of money, a home equity loan or HELOC is worth considering. Be sure to understand that these loans have advantages and some drawbacks.

Pros

- If you qualify, a home equity loan or HELOC is relatively easy to get.

- Interest rates are typically much lower than those of credit cards and other unsecured personal loans.

- Because home equity loans and HELOCs provide access to large sums of cash, they’re ideal for significant needs such as major home improvements or debt consolidation.

- Fixed rates are available for home equity loans, allowing homeowners to manage their monthly budgets better.

Cons

- You may have to pay closing costs .

- If you sell your home, you’ll have to pay off both the primary mortgage and the home equity loan or HELOC balance.

- HELOCs typically have variable interest rates, meaning the monthly payment could fluctuate over time.

- Because they’re so easy — and tempting — to get, you could find yourself in a debt spiral if you lack good financial habits.

- Because the home is used as collateral, you may risk foreclosure if you can’t repay the loan.

Best practices if you plan to get a home equity loan or HELOC

To ensure you get the most out of the equity you’ve built in your home, follow a few best practices when considering taking out a home equity loan or HELOC.

- Develop solid financial habits: budgeting, steady income, a plan to pay down your debts, a good credit history, and an emergency expense fund.

- Have a plan to pay back the loan or HELOC. Remember that your home is your collateral when you tap into your home equity. If you can’t repay, you risk hurting your credit, or worse, you risk losing your home.

- Focus your home equity financing on improving your long-term financial situation. Use it to add value to your home, consolidate and save money on your high-interest debt, pay for education (leading to greater earning potential), or pay for a significant emergency that your regular cash flow cannot cover. Many experts recommend against using home equity loans and HELOCs to fund vacations, car purchases, or high-risk investments.

- Understand how your home equity financing will affect your taxes and whether you may qualify for any tax advantages.

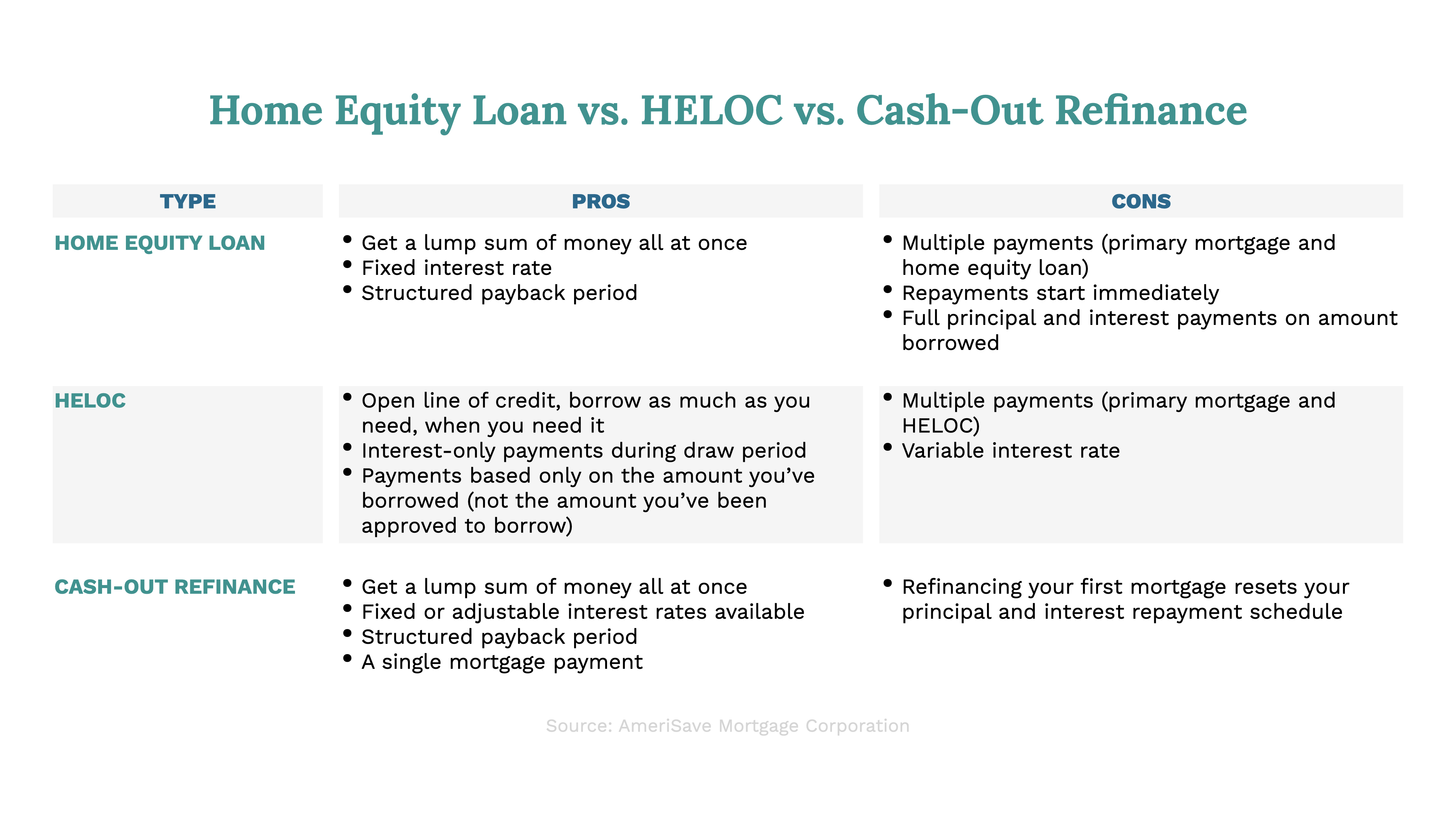

Home Equity Loan vs. HELOC vs. Cash Out Refinance

As you think about your borrowing needs, consider each of your home equity financing options.

While considering these options, remember that there’s no single correct answer. As everyone’s needs differ, so will their optimal approach to borrowing.

While considering these options, remember that there’s no single correct answer. As everyone’s needs differ, so will their optimal approach to borrowing.

“I recommend speaking with a mortgage banker who specializes in all three types of home equity borrowing to figure out what’s best for you and your family,” says Bloch. “I believe that a licensed mortgage banker can help you make the right choice because there are pros and cons to each approach.”

A powerful tool to achieve your goals

Home equity can be a powerful tool to help you achieve your financial goals. Contact an AmeriSave mortgage banker to learn more about how you can tap into yours.

Frequently asked questions about home equity financing

How much can I borrow against my home equity?

Most lenders will allow you to borrow up to 80% of the equity in your home. You’ll need to meet their requirements for credit score, debt-to-income ratio, and loan-to-value ratio, and will likely need to appraise your home.

Is home equity financing tax deductible?

The interest on a home equity loan or line is tax deductible as long as the total of your balances for that loan and your primary mortgage is less than $750,000, and you use the loan to buy, build, or improve a primary or secondary home. You can usually deduct at least part of the interest if your balance exceeds this amount.

This tax information is provided for general purposes only and should not be relied on or construed as tax advice. Consult with a qualified tax preparer for more information.

What is a HELOC?

A HELOC, or home equity line of credit, allows you to leverage the equity you’ve built in your home to get cash for home improvements or other expenses. Unlike a home equity loan, you don’t have to get a lump sum payment at closing. Instead, your lender extends you a line of credit that you can draw from as needed over a specified period. In this way, you can get just the money you need, as you need it. HELOCs typically have lower closing costs than a home equity loan but a variable interest rate that may balloon over time.

AmeriSave Mortgage

AmeriSave Mortgage AmeriSave Mortgage

AmeriSave Mortgage

AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation AmeriSave Corporation

AmeriSave Corporation AmeriSave Mortgage Corporation

AmeriSave Mortgage Corporation